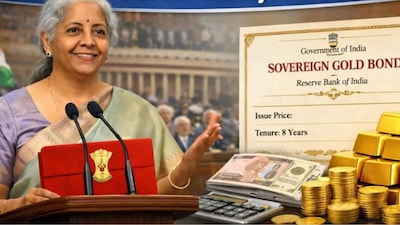

SGB Tax Rules to Change: What Investors Need to Know by April 2026

Business

M

Moneycontrol•01-02-2026, 14:54

SGB Tax Rules to Change: What Investors Need to Know by April 2026

- •Tax-free maturity benefit on Sovereign Gold Bonds (SGBs) will apply only if purchased directly from RBI at original issue and held until maturity.

- •The amendment takes effect on April 1, 2026, for the 2026-27 tax year and subsequent years.

- •Finance Bill 2025 specifies capital gains exemption for individuals holding SGBs from original issue to maturity.

- •SGBs are government-backed bonds issued by RBI, offering investment in gold with a 2.5% annual interest and an eight-year maturity with a five-year early exit option.

- •Investors buying SGBs from the secondary market may not qualify for capital gains tax exemption at maturity under the new rules.

Why It Matters: New SGB tax rules from April 2026 limit capital gains exemption to original investors holding till maturity.

✦

More like this

Loading more articles...