Gold Tax Guide: Understand Tax Rules for Physical Gold, ETFs, SGBs, and Inherited Gold

N

News18•20-02-2026, 17:16

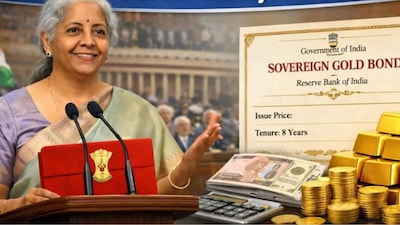

Gold Tax Guide: Understand Tax Rules for Physical Gold, ETFs, SGBs, and Inherited Gold

- •Different forms of gold (physical, ETFs, SGBs, inherited) have varying tax implications in India.

- •Physical gold incurs 3% GST on value and 5% GST on making charges; capital gains tax applies upon sale.

- •Gold ETFs have no initial GST, but capital gains tax applies upon sale, similar to physical gold.

- •Sovereign Gold Bonds (SGBs) offer significant tax benefits: no GST on purchase, and capital gains are tax-exempt if held until 8-year maturity.

- •Inherited gold is tax-free upon receipt; tax only applies when sold, with the original owner's holding period considered for capital gains.

✦

More like this

Loading more articles...