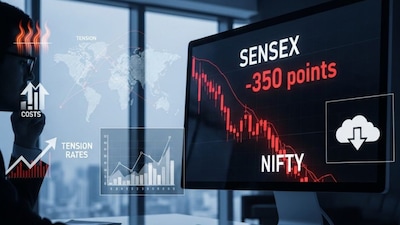

FIIs Pull Out Rs 11,700 Crore in January: Global Tensions, Tariffs Drive Sell-off

Business

N

News18•11-01-2026, 09:31

FIIs Pull Out Rs 11,700 Crore in January: Global Tensions, Tariffs Drive Sell-off

- •Foreign portfolio investors (FPIs) have net sold Indian equities worth Rs 11,789 crore in January 2026 so far, continuing the 2025 outflow trend.

- •Key factors driving the sell-off include fresh tariff threats from the United States on Indian goods, linked to India's purchase of Russian oil.

- •Heightened geopolitical tensions globally, including military activity in Venezuela and Middle East instability, are prompting risk-off behavior.

- •Currency volatility, particularly a strong US dollar and a weaker Indian rupee, reduces returns for foreign investors.

- •Broader global macroeconomic concerns, US Federal Reserve policy uncertainty, and the absence of a US-India trade agreement also contribute to FII caution.

Why It Matters: FIIs continue to exit Indian markets due to global trade tensions, geopolitical risks, currency volatility, and macro headwinds.

✦

More like this

Loading more articles...